The Rise of SWIB – A True Story (Mostly)

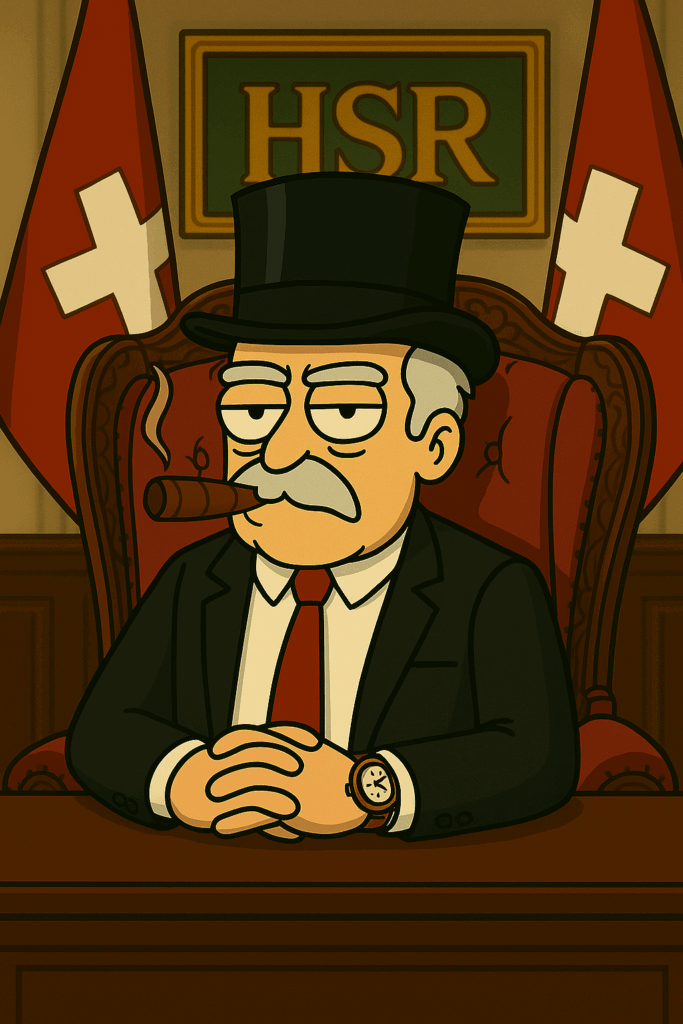

For decades, Otto von Straff was untouchable.

As chairman of a discreet Zürich vault network known only as “The Helvetic Strategic Reserves”, Otto oversaw fortunes that funded governments, wars, and institutions with plaques no one dared read. His motto was simple:

“Trust is for amateurs. Control is for bankers.”

But Otto made one mistake — he hesitated. While he was sipping vintage Armagnac and betting against countries, a new generation was minting JPEGs of monkeys and flipping tokens named after lunch meats.

And that’s when he saw the headline:

“ShibaCoin Outpaces Swiss National Bank.”

Disgusted but intrigued, Otto called in a disgraced former intern: Ledger Blunt, a 27-year-old dropout who once accidentally leaked internal memos on-chain — then sold them as NFTs. Fired, mocked, and banned from Credit Suisse cafeterias, Ledger had become a crypto cult figure.

They met in secret on a pier in Zermatt. Ledger in sunglasses and a trench coat. Otto in his signature three-piece suit and frown.

“What if we built a coin,” Ledger asked, “that looked like a joke… but outlived the punchline?”

“Only if we control the narrative,” Otto replied, exhaling smoke. “And the vault.”

And so, in a basement full of vintage ledgers and burner phones, SWIB was born — the Swiss Banker Coin.

Not a scam. Not a stock.

A weaponized meme backed by arrogance, precision, and absolutely zero accountability.

No pitch decks. No VC. Just vibes and vaults.

They didn’t just launch a token.

They declared financial war — dressed in suits, sunglasses, and smirks.